Creating a legal will is one of the most important decisions you'll make for your family's future. But when it comes to actually getting it done, you face a critical choice: hire a legal will lawyer or tackle it yourself with DIY tools. Both approaches can result in a valid, legally binding document, yet they offer vastly different experiences, costs, and levels of protection.

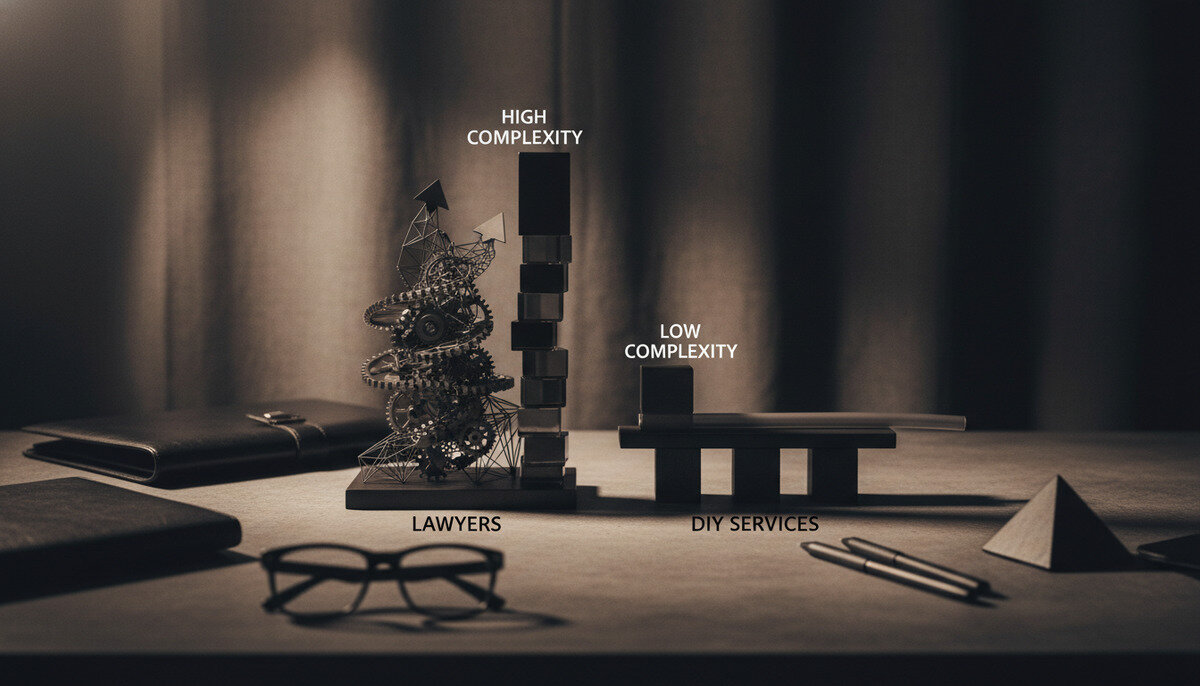

A legal will lawyer brings decades of training, state-specific expertise, and personalized guidance to ensure your wishes are properly documented and legally sound. DIY will services, on the other hand, offer convenience and affordability through online platforms that guide you through standardized templates. The right choice depends on your specific situation, the complexity of your estate, and your comfort level with legal processes.

In this comprehensive comparison, we'll examine both options across key criteria including cost, complexity handling, legal protection, time investment, and long-term reliability. You'll discover when each approach makes the most sense, what red flags to watch for, and how to make an informed decision that protects your family's future.

Understanding Your Legal Will Options

When it comes to creating a legally binding will, you essentially have two primary paths: working with a qualified legal will lawyer or using a DIY approach through online services or self-preparation. Each method has evolved significantly over the past decade, with technology making DIY options more sophisticated while legal professionals have adapted their services to compete in an increasingly digital marketplace.

(https://willandtrustmaker.com/how-to-draft-legal-documents/) with client in modern law office]

A legal will lawyer represents the traditional approach that has been the gold standard for estate planning for centuries. These attorneys specialize in estate law, understand the nuances of state-specific requirements, and can navigate complex family situations, business ownership, and substantial assets. They provide personalized consultation, draft custom documents, and offer ongoing legal support.

The DIY approach encompasses everything from basic fill-in-the-blank forms to sophisticated online platforms that use guided interviews to create customized wills. Modern DIY services like those offered through Will & Trust have transformed simple template-based systems into comprehensive estate planning tools that can handle moderately complex situations while maintaining affordability and convenience.

Why It Matters: The choice between these approaches isn't just about cost—it's about ensuring your final wishes are legally sound, properly executed, and will hold up when your family needs them most.

The Evolution of Will Creation

The legal landscape has changed dramatically in recent years. According to the American Bar Association, approximately 68% of American adults don't have a will, often citing cost and complexity as primary barriers. This gap has created space for innovative DIY solutions that make estate planning more accessible.

Legal will lawyers have responded by offering more flexible service models, including limited-scope representation, flat-fee arrangements, and hybrid approaches that combine attorney oversight with client self-service. Meanwhile, DIY platforms have invested heavily in legal accuracy, state-specific compliance, and user experience improvements.

Key Factors in Your Decision

Several critical factors should influence your choice between a legal will lawyer and DIY approach:

- Estate Complexity: Simple estates with straightforward asset distribution favor DIY, while complex situations require professional expertise

- Family Dynamics: Blended families, estranged relatives, or potential disputes often need attorney guidance

- Asset Types: Business ownership, real estate in multiple states, or substantial investments typically require legal expertise

- Time Sensitivity: DIY options can produce results in hours, while attorney consultation may take weeks to schedule

- Budget Constraints: DIY services cost $50-200, while attorneys typically charge $300-1,500 for basic wills

- Peace of Mind: Some people simply feel more confident with professional legal guidance

Detailed Comparison: Lawyer vs DIY Approach

Understanding the specific differences between legal will lawyers and DIY approaches requires examining multiple dimensions of the will creation process. Each method excels in different areas while presenting unique challenges and limitations.

Cost Analysis and Value Proposition

The financial difference between these approaches is often the first consideration for most people. Legal will lawyers typically charge between $300-1,500 for a basic will, with costs increasing significantly for complex estates. This fee usually includes initial consultation, document drafting, review sessions, and execution guidance. More complex situations involving trusts, business succession, or tax planning can cost $2,000-5,000 or more.

DIY services present a dramatically different cost structure. Basic online will services range from $50-200, with premium packages including additional documents like power of attorney and healthcare directives costing $200-400. These services often include unlimited revisions, document storage, and basic customer support.

Key Insight: While the upfront cost difference is substantial, consider the long-term value. A properly drafted attorney will that prevents family disputes or tax complications can save thousands in legal fees and preserve family relationships.

Complexity and Customization Capabilities

Legal will lawyers excel at handling complex situations that don't fit standard templates. They can navigate intricate family structures, business ownership arrangements, charitable giving strategies, and tax minimization techniques. Attorneys understand how different estate planning documents work together and can create comprehensive strategies that address multiple goals simultaneously.

DIY services have improved significantly in handling moderate complexity but still operate within template-based frameworks. Modern platforms can accommodate blended families, multiple properties, specific bequests, and guardian appointments. However, they struggle with unique situations, complex business arrangements, or sophisticated tax planning strategies.

Legal Protection and Accuracy

The legal protection offered by each approach differs substantially. Legal will lawyers carry professional liability insurance and are bound by ethical obligations to provide competent representation. If errors occur, clients have recourse through malpractice claims and state bar disciplinary processes. Attorneys also stay current on changing laws and can update documents as needed.

DIY services typically disclaim legal responsibility and cannot provide legal advice. While reputable platforms invest in legal accuracy and state-specific compliance, users bear ultimate responsibility for document correctness. Some services offer limited guarantees or insurance coverage, but protection is generally less comprehensive than attorney representation.

Time Investment and Convenience

DIY services offer unmatched convenience and speed. Most people can complete a basic will in 30-60 minutes using guided online interviews. Documents are available immediately for download, printing, and execution. This approach works well for people with straightforward situations who value immediate results.

Legal will lawyers require more time investment but provide personalized attention. Initial consultations typically last 60-90 minutes, followed by document review sessions and execution meetings. The entire process usually takes 2-4 weeks from initial contact to completed documents. While slower, this timeline allows for careful consideration and customization.

When to Choose a Legal Will Lawyer

Certain situations strongly favor working with a qualified legal will lawyer despite the higher cost and time investment. Understanding these scenarios can help you make an informed decision about when professional legal expertise becomes essential rather than optional.

Complex Estate Situations

Legal will lawyers become invaluable when dealing with complex estate situations that extend beyond simple asset distribution. If you own a business, have real estate in multiple states, or possess substantial investment portfolios, attorney guidance ensures proper handling of these sophisticated assets. Business succession planning, in particular, requires careful coordination between estate planning documents and business agreements.

High-net-worth individuals often face estate tax implications that DIY services cannot adequately address. The federal estate tax exemption changes periodically, and state estate taxes vary significantly. An experienced estate planning attorney can implement strategies to minimize tax burden while ensuring your wishes are properly executed.

Expert Tip: If your estate exceeds $1 million in value or includes complex assets like business interests, professional artwork, or intellectual property, the cost of attorney fees often represents a small fraction of the potential savings and protection provided.

Complicated Family Dynamics

Blended families, estranged relatives, or potential inheritance disputes require the nuanced approach that only experienced legal will lawyers can provide. These attorneys understand how to structure documents to minimize challenges and can anticipate potential problems based on family dynamics and state law.

Situations involving minor children from previous marriages, disabled beneficiaries requiring special needs planning, or concerns about financial responsibility of heirs benefit significantly from attorney guidance. Legal will lawyers can recommend trust structures, guardian appointments, and distribution strategies that protect vulnerable family members.

Business Ownership and Professional Practice

Business owners face unique challenges in estate planning that extend far beyond simple will creation. Professional practices, partnerships, and closely held corporations require coordination between estate planning documents and business agreements. Legal will lawyers understand how business succession planning integrates with personal estate planning.

Key considerations include:

- Buy-sell agreements and their interaction with estate plans

- Professional liability concerns and asset protection strategies

- Succession planning for key employees and business continuity

- Tax implications of business transfers at death

- Regulatory requirements for licensed professionals

Geographic Complexity

If you own property in multiple states or have beneficiaries scattered across different jurisdictions, legal will lawyers provide essential expertise in navigating varying state laws. Real estate transfers, tax implications, and probate procedures differ significantly between states, requiring careful coordination to avoid complications.

When DIY Will Services Make Sense

DIY will services have evolved into sophisticated platforms that can effectively serve many people's estate planning needs. Understanding when these services provide adequate protection helps you recognize situations where the convenience and cost savings outweigh the benefits of attorney representation.

Straightforward Estate Planning Needs

DIY services excel when your estate planning needs fit within common patterns and don't require extensive customization. If you're married with children, own a home and standard investment accounts, and want to leave everything to your spouse with children as backup beneficiaries, online platforms can handle this efficiently and accurately.

Single individuals with straightforward wishes, such as leaving assets to siblings, parents, or charities, also find DIY services well-suited to their needs. The guided interview process walks you through essential decisions while ensuring state-specific legal requirements are met.

Budget-Conscious Individuals and Families

For many people, the choice between having a DIY will and no will at all makes the decision clear. If attorney fees represent a significant financial burden, a properly executed DIY will provides substantial protection compared to dying intestate (without a will). The cost difference often enables people to create comprehensive estate planning documents who might otherwise procrastinate indefinitely.

Young families with limited assets but important decisions about child guardianship particularly benefit from DIY services. The primary concern isn't complex asset distribution but ensuring proper guardian appointments and basic financial protection for children.

Tech-Savvy Users Who Value Control

Some people prefer the control and transparency that DIY services provide. These platforms allow you to see exactly what goes into your documents, make changes at your own pace, and understand each decision point in the process. This approach appeals to individuals who research thoroughly and want to understand their estate planning choices completely.

The ability to update documents easily as life circumstances change also appeals to people who anticipate regular revisions. DIY services typically allow unlimited updates, making it easy to adjust beneficiaries, add new assets, or modify distributions without additional attorney fees.

Time-Sensitive Situations

When you need a will quickly due to travel, medical procedures, or other time-sensitive circumstances, DIY services provide immediate solutions. While not ideal for complex situations, a properly executed DIY will offers significant protection compared to having no will at all during emergency situations.

Comparison Analysis: Key Decision Factors

Making an informed choice between a legal will lawyer and DIY services requires examining multiple factors systematically. This analysis helps you weigh the trade-offs and identify which approach better serves your specific situation and priorities.

Comprehensive Cost-Benefit Analysis

The cost comparison extends beyond simple upfront fees to include long-term value and potential consequences. Legal will lawyers typically charge $300-1,500 for basic wills, with complex situations costing significantly more. However, this investment includes professional liability protection, ongoing relationship for updates, and expertise in avoiding costly mistakes.

DIY services cost $50-400 for comprehensive packages but shift risk to the user. While the immediate savings are substantial, consider potential costs if documents are challenged, contain errors, or fail to achieve your intended goals. The peace of mind factor also has value that varies by individual.

Quality and Legal Compliance Comparison

| Factor | Legal Will Lawyer | DIY Service |

|---|---|---|

| Legal Accuracy | Professional expertise with liability coverage | Template-based with user responsibility |

| State Compliance | Current knowledge of local laws | Automated updates with general compliance |

| Customization | Unlimited customization for unique situations | Template variations with moderate flexibility |

| Error Protection | Professional review and malpractice insurance | User verification with limited guarantees |

| Updates | Professional monitoring of law changes | Periodic platform updates with user notification |

Key Takeaway: Legal will lawyers provide higher assurance of accuracy and compliance but at significantly higher cost. DIY services offer good protection for straightforward situations but require user diligence for optimal results.

Accessibility and User Experience

DIY services excel in accessibility and user experience design. Modern platforms guide users through complex decisions with plain-language explanations, visual aids, and logical flow. Most people can complete a basic will in under an hour from any location with internet access.

Legal will lawyers provide personalized attention but require scheduling, travel, and coordination challenges. However, this personal interaction allows for detailed discussion of concerns, exploration of options, and confidence-building through professional guidance.

Long-Term Relationship and Support

The ongoing relationship aspect differs significantly between approaches. Legal will lawyers typically maintain client relationships over decades, providing updates as laws change, life circumstances evolve, and estate planning needs become more sophisticated. This continuity of care ensures your documents remain current and effective.

DIY services provide transactional relationships focused on document creation rather than ongoing estate planning guidance. While some platforms offer customer support and update notifications, users bear responsibility for recognizing when changes are needed and implementing them appropriately.

Common Mistakes to Avoid with Each Approach

Understanding common pitfalls associated with both legal will lawyers and DIY services helps you make better decisions and avoid costly errors regardless of which path you choose.

Lawyer-Related Mistakes

Even when working with legal will lawyers, clients can make mistakes that compromise their estate planning effectiveness. One common error is failing to communicate complete information about assets, family dynamics, or personal wishes. Attorneys can only provide guidance based on the information they receive, so withholding details about estranged relatives, hidden assets, or complex relationships can lead to inadequate planning.

Another frequent mistake is choosing attorneys based solely on cost rather than expertise. Estate planning requires specialized knowledge that differs significantly from other legal areas. A general practice attorney may charge less but lack the specific expertise needed for effective estate planning. Always verify that your chosen attorney has substantial estate planning experience and current knowledge of relevant laws.

Procrastination represents another significant mistake when working with attorneys. The formal process and higher cost can lead to indefinite delays in completing documents. Many people schedule initial consultations but fail to follow through with document completion, leaving their families unprotected despite good intentions.

Pro Tip: When working with a legal will lawyer, prepare a comprehensive list of assets, family information, and specific wishes before your initial consultation. This preparation maximizes the value of your attorney's time and ensures nothing important is overlooked.

DIY Service Pitfalls

DIY service users face different but equally important potential mistakes. The most common error is overestimating the simplicity of their situation. Many people assume their estate planning needs are straightforward when they actually involve complexities that require professional attention. Business ownership, real estate in multiple states, or complicated family dynamics often exceed DIY service capabilities.

Inadequate execution represents another frequent problem with DIY wills. While platforms provide guidance on signing requirements, users must ensure proper witnessing, notarization (where required), and storage of executed documents. Failure to follow state-specific execution requirements can invalidate otherwise properly drafted documents.

Failing to update documents as circumstances change is particularly problematic with DIY services. Without ongoing professional relationships, users may not recognize when life changes require document updates. Marriage, divorce, births, deaths, or significant asset changes all potentially require will modifications.

Universal Mistakes Across Both Approaches

Regardless of which approach you choose, certain mistakes can compromise your estate planning effectiveness. Failing to communicate your wishes to family members often leads to confusion and disputes even with properly drafted documents. Your will should be part of broader family conversations about your values and intentions.

Neglecting to coordinate your will with other estate planning documents and beneficiary designations creates potential conflicts. Life insurance policies, retirement accounts, and joint property ownership all transfer outside your will, so ensuring consistency across all documents is essential.

Not considering tax implications, even for modest estates, can result in unnecessary burden on your beneficiaries. While DIY services provide limited tax guidance and attorneys offer comprehensive tax planning, both approaches require attention to potential tax consequences of your distribution choices.

Making Your Decision: A Framework

Choosing between a legal will lawyer and DIY services requires systematic evaluation of your specific circumstances against the strengths and limitations of each approach. This decision framework helps you analyze key factors objectively and make an informed choice.

Situation Assessment Checklist

Begin by honestly evaluating your situation across multiple dimensions. Estate complexity serves as the primary factor—simple estates with straightforward beneficiaries and standard assets generally work well with DIY services, while complex situations benefit from attorney expertise.

Family dynamics require careful consideration. Harmonious families with clear communication and shared values face fewer challenges than families with potential conflicts, estranged relatives, or complicated relationships. Blended families, in particular, often benefit from attorney guidance in structuring distributions and guardian appointments.

Financial considerations extend beyond simple cost comparison. Consider your estate's total value, potential tax implications, and the financial impact of mistakes or challenges. High-value estates often justify attorney costs through tax savings and dispute prevention.

Risk Tolerance Evaluation

Your comfort level with legal risk significantly influences the appropriate choice. Some people feel confident taking responsibility for document accuracy and compliance, while others prefer professional oversight and liability protection. Neither approach is inherently right or wrong—the key is matching your choice to your risk tolerance.

Consider the consequences of errors or oversights in your specific situation. If mistakes would primarily affect asset distribution among agreeable family members, the risk may be acceptable. However, if errors could trigger family disputes, tax problems, or business complications, professional protection becomes more valuable.

Key Insight: Your risk tolerance should align with your situation's complexity. Simple situations can accommodate higher risk tolerance, while complex circumstances require more conservative approaches regardless of personal preferences.

Decision Matrix Application

Create a simple scoring system to evaluate your situation objectively:

Complexity Factors (Score 1-5, with 5 being most complex):

* Asset types and values

* Family structure and relationships

* Business ownership or professional practice

* Geographic distribution of assets

* Tax planning needs

* Special circumstances (disabled beneficiaries, charitable giving, etc.)

Resource Factors:

* Available budget for estate planning

* Time constraints and urgency

* Comfort level with legal responsibility

* Desire for ongoing professional relationship

Scores consistently above 3 in complexity factors generally favor attorney representation, while lower scores suggest DIY services may be appropriate. Resource factors help determine feasibility and preference alignment.

Implementation Strategy

Once you've made your decision, develop an implementation strategy that maximizes your chosen approach's benefits while minimizing potential drawbacks. For DIY services, this might include thorough research of platform options, careful attention to execution requirements, and planning for periodic updates.

For attorney representation, focus on finding qualified estate planning specialists, preparing thoroughly for consultations, and establishing clear communication about your goals and concerns. Consider the attorney's experience with situations similar to yours and their approach to client relationships.

Regardless of your choice, plan for document maintenance and updates as your life circumstances change. Estate planning is not a one-time event but an ongoing process that requires periodic attention to remain effective.

Common Questions About Legal Will Creation

Understanding frequently asked questions about legal will creation helps clarify important concepts and address common concerns that arise when choosing between professional legal assistance and DIY approaches.

How do I know if my situation is too complex for DIY services?

Several indicators suggest your situation may exceed DIY service capabilities and benefit from attorney guidance. Business ownership, whether in a professional practice, partnership, or corporation, typically requires coordination between estate planning and business succession planning that DIY services cannot provide adequately.

Significant assets, generally exceeding $1 million in total value, often trigger estate tax considerations and sophisticated planning strategies that require professional expertise. Real estate ownership in multiple states creates jurisdictional complications that attorneys handle more effectively than standardized online platforms.

Family complexity also indicates potential need for attorney assistance. Blended families with children from previous marriages, estranged relatives who might challenge your will, or concerns about beneficiaries' financial responsibility often benefit from professional guidance in structuring distributions and minimizing conflict potential.

Expert Tip: If you find yourself asking "what if" questions about unusual circumstances or potential complications, these concerns often indicate complexity that benefits from attorney consultation, even if you ultimately choose a DIY approach for document creation.

What happens if there are errors in my DIY will?

Errors in DIY wills can range from minor technical issues to major problems that invalidate the entire document. Minor errors, such as incorrect dates or small formatting issues, typically don't affect the will's validity if the overall intent is clear and execution requirements are met properly.

More serious errors can have significant consequences. Improper execution, such as inadequate witnessing or notarization where required, can invalidate the entire will. Unclear language or contradictory provisions may require court interpretation, potentially leading to outcomes different from your intentions.

The most serious errors involve fundamental legal mistakes, such as attempting to dispose of property that transfers outside the will (like joint property or retirement accounts with beneficiary designations) or failing to address residuary clauses that dispose of assets not specifically mentioned.

How often should I update my will regardless of the creation method?

Estate planning experts recommend reviewing your will every three to five years and updating it whenever significant life changes occur. Major life events that typically require will updates include marriage, divorce, births, deaths of beneficiaries or named executors, and significant changes in asset values or types.

Geographic moves, particularly to different states, often require will updates to ensure compliance with new state laws and optimal probate procedures. Changes in relationships with beneficiaries, such as estrangement or reconciliation, also warrant document review and potential modification.

Business changes, including starting a new business, selling existing businesses, or changes in business structure, frequently require estate planning updates to maintain coordination between personal and business succession planning.

Can I switch from DIY to attorney assistance later?

Absolutely. Many people begin with DIY services and later engage attorneys as their situations become more complex or their comfort level with legal responsibility changes. Attorneys can review existing DIY documents and recommend modifications or complete rewrites as needed.

This progression often makes sense for young families who start with simple DIY wills focusing on guardian appointments and basic asset distribution, then engage attorneys as their estates grow and planning needs become more sophisticated.

When transitioning from DIY to attorney assistance, bring all existing estate planning documents, asset information, and specific concerns or questions that prompted your decision to seek professional help. This information helps attorneys understand your situation quickly and provide targeted guidance.

What credentials should I look for in a legal will lawyer?

When selecting a legal will lawyer, prioritize attorneys who specialize in estate planning rather than general practitioners who handle wills occasionally. Look for attorneys who devote substantial portions of their practice to estate planning, trust administration, and related areas.

Professional credentials that indicate specialized expertise include board certification in estate planning (where available), membership in estate planning professional organizations, and continuing education focused on estate and tax law. Many qualified estate planning attorneys also hold additional credentials like LLM degrees in taxation or estate planning.

Experience with situations similar to yours is particularly valuable. If you own a business, seek attorneys with business succession planning experience. For high-net-worth individuals, look for attorneys experienced in estate tax planning and sophisticated trust structures.

How do DIY services ensure legal compliance across different states?

Reputable DIY services invest significantly in legal research and state-specific compliance systems. They typically employ legal teams that monitor law changes across all states and update their platforms accordingly. Most services generate documents based on your state of residence and incorporate state-specific requirements automatically.

However, DIY services face limitations in handling multi-state complications, such as real estate ownership across state lines or beneficiaries in different jurisdictions. These situations often benefit from attorney consultation to ensure optimal planning across multiple legal systems.

The quality of legal compliance varies significantly among DIY services. Research platform reputation, legal team credentials, and user reviews to assess compliance quality. Look for services that clearly explain their legal review processes and provide regular updates about law changes.

Conclusion

Choosing between a legal will lawyer and DIY services ultimately depends on balancing your specific circumstances, risk tolerance, and resources against the strengths and limitations of each approach. Legal will lawyers provide unmatched expertise, customization, and professional protection for complex situations, business ownership, high-value estates, and complicated family dynamics. Their guidance becomes invaluable when mistakes could trigger family disputes, tax complications, or business succession problems.

DIY services offer compelling advantages for straightforward situations, budget-conscious individuals, and those who value convenience and control. Modern platforms have evolved into sophisticated tools that can handle moderate complexity while maintaining affordability and accessibility. For many families, a properly executed DIY will provides substantial protection compared to having no will at all.

The key is honest assessment of your situation's complexity and your comfort level with legal responsibility. Simple estates with harmonious families and standard assets often work well with DIY approaches, while complex circumstances benefit from professional expertise regardless of cost considerations.

Remember that estate planning is an ongoing process, not a one-time event. Your choice today doesn't lock you into a permanent approach—many people begin with DIY services and later engage attorneys as their situations evolve. The most important step is taking action to protect your family's future, whether through professional guidance or quality DIY services.

Ready to explore your estate planning options? Get started with Will & Trust to discover comprehensive tools and resources that can help you create the legal protection your family deserves.